Problems facing Chinese economy are resolvable

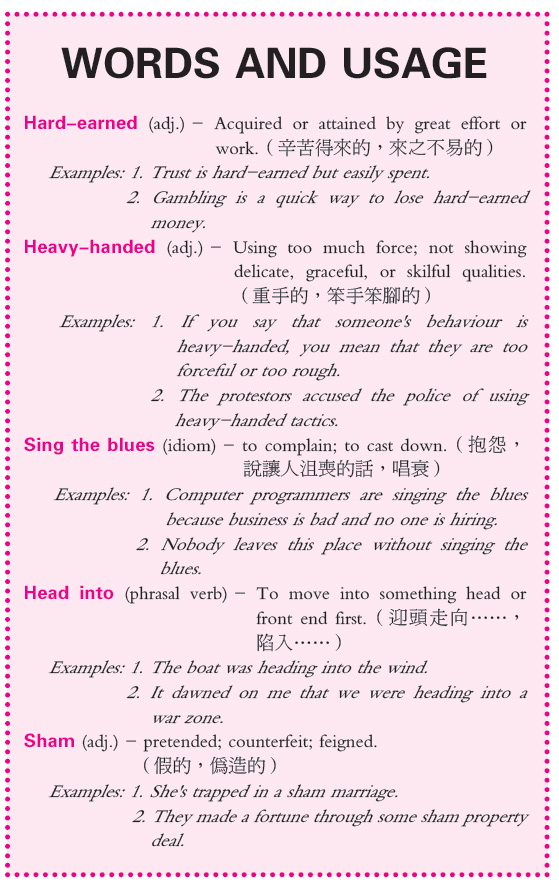

China yesterday released a report on its economic and social development in 2013, which shows the Chinese economy has performed well and its outlook is also good. This is evident that those Westerners bad-mouthing China's economy are divorced from reality and make a distortion out of ulterior motives. Surely, under the complicated and changing situation with problems turning up at home and abroad, China must be on its guard and avoid making mistakes and lapses, so as to safeguard the hard-earned macro-economic pattern of relatively high-speed growth.

Last year, China's economy started with a weak beginning and it was in a disadvantaged position of continuous slowdown in the first half of the year. Fortunately, Chinese authorities were able to handle it properly, managing to keep economic activities stable while not overdoing it by rushing to take heavy-handed stimulus measures. As a result, the economy stopped the slowdown and stabilised again in the second half. In the end, GDP (gross domestic product) growth for the whole year still reached 7.7%, higher than the 7.5% goal set at the beginning of last year. At the same time, Consumer Price Index (CPI) mildly rose 2.6%. With relatively good growth momentum, low inflation was still maintained, which indicated that the macro-economic pattern of relatively high-speed growth could still be maintained.

China's economic development is gradually shifting its focus from quantity to quality. GDP growth is no longer regarded as a hard goal, and more attention is paid to optimizing economic structure and system and improving overall efficiency. In fact, as long as China could maintain an annual growth of at least 7.2%, it can ensure sufficient employment and meet the requirement of doubling its GDP in a decade. Therefore, despite the lower growth rate, its economic growth in fact is still not slow, much faster than all other major economies in the world.

At the same time, attention should be given to progresses in many other aspects. The first is the improvement of efficiency. Last year overall labour productivity grew over 7% from a year before, which was comparatively a high level in the world. This has not only laid a foundation for improving people's living standards but also is favourable to deal with problems such as "shortage of migrant workers" and decrease in labour force due to population aging. The second is that Chinese people could fully benefit from economic growth as their living conditions improve quickly. Last year, average per capita disposable income in the country rose more than 8%, higher than the rate of GDP growth. At the same time, urban-rural differences narrowed with wealth distribution tending to be fairer. Finally, development indicators such as industrial structure and urbanisation have steadily improved: urbanisation rate rose over 1% and the tertiary industry accounted for 46% of the whole economy, surpassing the secondary industry for the first time. This suggests China starts to enter a new stage of service based economy.

As Chinese economy maintains stability and makes steady progress, many commentators in the West are rather singing the blues. They infinitely exaggerate some difficulties facing the Chinese economy and interpret some fluctuating data as signs of a downturn, using them to derive at all sorts of "hard-landing" and "collapsing" theories. Of course, there are a few more objective and pragmatic commentators who point out that, years of experience show the winning chance of betting on China meeting with a mishap is very tiny. Inevitably, behind "singing the blues" there are hidden conspiracies. First, by badmouthing emerging economies, they want to lure capital back to Europe and US to help reduce the shock brought up by US stimulus withdrawal. In fact, when the Federal Reserve (Fed) announced to reduce bond buying, US treasury bonds went up instead of going down. This was exactly because risk-hedging "hot money" flew back to the rescue. However, eventually, owners of these funds will find out that they are not hedging but heading into risks. Secondly, they really feel the threat of China: with its growing economic muscle, China's international influence grows increasingly, which is bound to accelerate the comparative fall of the West and to end the era of Western dominance. Therefore, they want to "sing the blues" about China for self-consolation.

No doubt, China as a developing country still has many shortcomings at economic level, in its system and policy implementation, which have yet to be overcome as quickly as possible. Pressures accumulated in fast development in many years also need to be relieved. But China's economy is still vigorous and has the potential of making use of the advantages of a late comer. And many development dividends could be released through reform and structural optimization. What China is facing is problems in development which are resolvable, absolutely unlike the West especially the US where sham prosperity is created by drinking poison to quench a thirst. As time goes by, China's advantage and strength will manifest itself even more clearly.

25 February 2014